ESG’s unbeatable energy sector experience and innovative solutions make our energy smart cloud the most relevant, popular, and reliable technology powering the market.

ESG’s unbeatable energy sector experience and innovative solutions make our energy smart cloud the most relevant, popular, and reliable technology powering the market.

It’s our job to help you gather better data, understand it more completely, and use it more effectively than you could alone, or with any other provider.

Whether you’re looking for data analytics, market messaging, billing, or customer relationship management we provide an integrated end-to-end platform to help you reduce your cost to serve, help you increase your effectiveness across all areas, and improve your efficiency.

Tried and Tested Technology

Our approach, software and technology has set the standard in the energy market for years. We are the benchmark for energy technology providers today.

Next generation levels of data handling

We build our products to process billions of rows of data. All our solutions are designed and tested to meet the future needs of an energy industry powering towards interval settlements, smart metering and beyond.

Focused on your business needs

We help you automate complex, time-consuming processes from operations into decisions – so you’re free to concentrate on building your business and looking after your customers.

Our technology, analytics and industry expertise will make your precious data even more valuable. The results you’ll get from elevated, data-driven decision making- in every area of your business – will be priceless.

We’re here to help you with your customer, meter, and data management today; and with the transition to the future grid and all of opportunities created by renewables, DERs, and EV loads tomorrow.

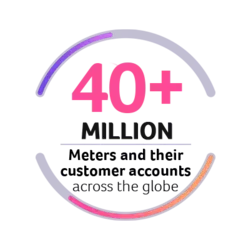

We’re the biggest independent provider of smart meter software anywhere in the world – helping you plug into the DCC with guaranteed industry compliance and security. We integrate with flexible API’s – helping you easily manage all your data in one place.

We work in a complex industry, and our customers know that we take our responsibility seriously. We will always work with you to put things right when they go wrong, and to work in your best interest at every stage of your journey.

Our team understands the complexities of the energy industry better than any other provider in the market. We engage with hundreds of energy forums and working groups in the US and UK. We share our thinking, publish industry white papers, host conferences, and our people speak at industry events – all to keep us up to date, and ahead of the game.

Many thanks for visiting our website. Utiligroup has now unified with ESG. You can find our new site at esgglobal.com - or please click the button below and you will be redirected to our new site.